- Home

- »

- Homecare & Decor

- »

-

Reusable Water Bottle Market Size, Industry Report, 2030GVR Report cover

![Reusable Water Bottle Market Size, Share & Trends Report]()

Reusable Water Bottle Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Stainless Steel, Glass), By Distribution Channel (Supermarkets & Hypermarkets, Online, Specialty Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-273-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Reusable Water Bottle Market Summary

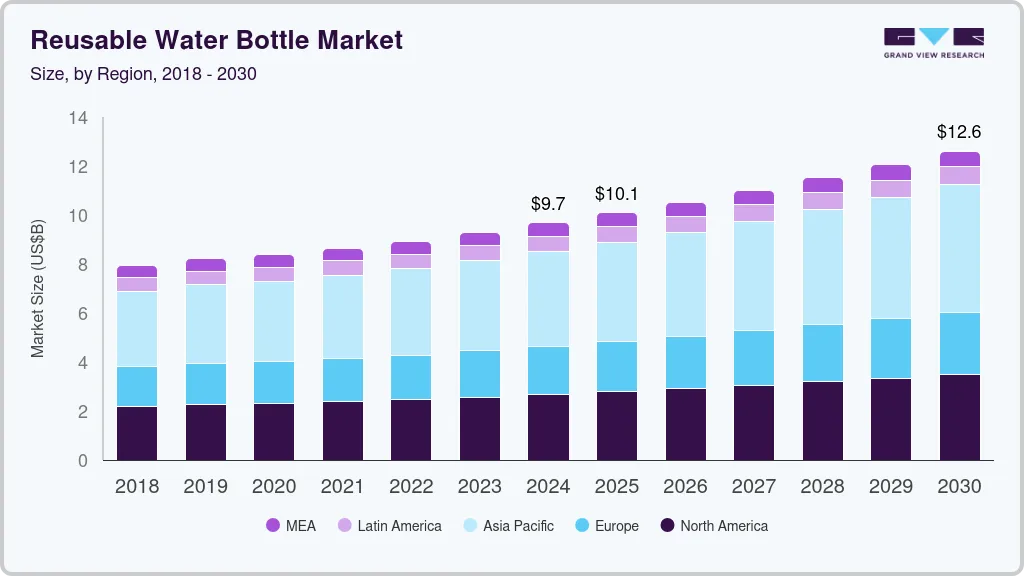

The global reusable water bottle market size was estimated at USD 9.67 billion in 2024 and is projected to reach USD 12.60 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. Increasing environmental awareness has led consumers to shift away from single-use plastics in favor of more sustainable options, such as reusable bottles.

Key Market Trends & Insights

- The North America reusable water bottle market accounted for a share of 27.58% of the global market revenue in 2024.

- The U.S. reusable water bottle market is expected to grow at a CAGR of 4.5% from 2025 to 2030.

- By material, the plastic segment reusable water bottle sales accounted for a revenue share of over 35% in 2024.

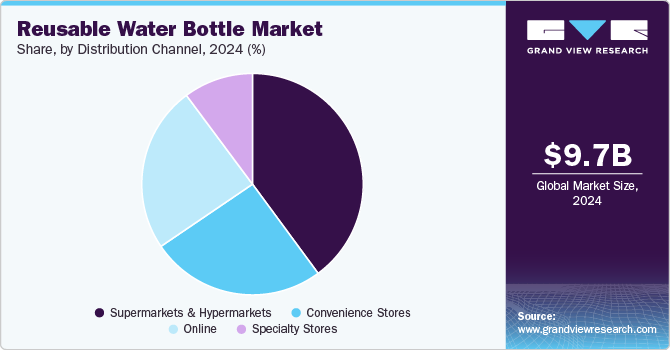

- By distribution channel, supermarkets/hypermarket-driven segment sales accounted for a revenue share of over 39% in 2024

Market Size & Forecast

- 2024 Market Size: USD 9.67 Billion

- 2030 Projected Market Size: USD 12.60 Billion

- CAGR (2025-2030): 4.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing focus on reducing plastic waste, coupled with rising health consciousness and the demand for eco-friendly products, has fueled this trend. In addition, heightened demand for kitchenware, including reusable bottles, surged during the COVID-19 pandemic as people spent more time at home and invested in long-term, sustainable household items. According to a blog post by Klarna, millennials and Generation X used a large portion of their income on home and garden products during the COVID-19 lockdown. These items included drinkware, kitchenware, as well as other household products.Reusable water bottles are becoming more and more popular across target markets worldwide, especially in homes, offices, and schools. These reusable bottles lessen the amount of plastic that ends up in landfills, which is what mostly contaminates groundwater. Also, the usage of reusable water bottles is being encouraged by rising awareness of the negative environmental effects of non-disposable and single-use plastic bottles as well as a major rise in the amount of plastic garbage in seas and landfills.

Also, governments around the world are taking steps to discourage the use of single-use plastic water bottles and encourage the use of reusable bottles made of glass, metal, and other environmentally benign and secure materials. For instance, the prohibition on single-use plastic water bottles in Australia, Canada, the United States, and some Indian states have created new growth opportunities for reusable bottles.

Also, a high propensity for picnics and outdoor recreation in city parks, local green spaces, and public trails suggests promising growth potential for reusable bottles of all kinds. For instance, the 2021 Maru Voice Canada poll found that 52% of Canadians are more likely to participate in outdoor leisure activities more frequently.

The trend of sustainability has had a significant impact on the reusable water bottle industry. Consumers are increasingly aware of the environmental impact of single-use plastic bottles and are opting for sustainable alternatives. This has led to a surge in demand for reusable water bottles that are made from recycled materials and are recyclable. To meet this demand, market players have been responding by introducing sustainable product lines that use recycled materials, reducing their carbon footprint, and promoting environmental-friendly manufacturing processes.

Material Insights

Plastic reusable water bottle sales accounted for a revenue share of over 35% in 2024. This is attributed to the low cost of manufacturing by producers. The greater life expectancy of plastic reusable water bottles has increased consumers’ interest in the consumption of reusable water bottles, which is supporting the growth of the segment. Over conventional plastic bottles, reusable bottles have a benefit. Moreover, over a million plastic bottles are bought in the United States every minute, according to the blog written by Earth Day organizers in 2023.

Stainless steel water bottle sales are projected to grow at a CAGR of 4.8% from 2025 to 2030. Stainless steel coated with copper is widely preferred among consumers owing to the numerous health benefits associated with copper. Stainless steel and copper-lined vacuum wood bottles are some of the latest trends in the product category.

Distribution Channel Insights

Supermarkets/hypermarket-driven sales accounted for a revenue share of over 39% in 2024, driven by their widespread accessibility, extensive product variety, and competitive pricing. These retail formats offer consumers the convenience of purchasing reusable water bottles alongside everyday essentials, appealing to a broad demographic. The ability to showcase products physically allows buyers to assess quality, design, and functionality firsthand, further boosting sales. In addition, supermarkets and hypermarkets frequently run promotional campaigns and discounts, making them a preferred choice for budget-conscious consumers, thereby solidifying their dominant share in the market.

Online sales are projected to grow at a CAGR of 5.2% from 2025 to 2030. Increased e-commerce and smart device adoption, together with simple payment methods and promotional offers, are driving this market's growth. Several producers use this route of distribution due to the simplicity of selling reusable bottles through custom logo printing. Manufacturers are offering their products through online channels due to consumers' growing demand for online purchasing in order to access a larger consumer base.

Regional Insights

The North America reusable water bottle market accounted for a share of 27.58% of the global market revenue in 2024. Urbanization and changes in lifestyle are the factors that are contributing to market growth across the world. People are moving toward a healthy lifestyle and are thinking of a sustainable environment, thus preferring reusable water bottles against ordinary disposable ones. Moreover, initiatives taken across the world to save marine life from the harmful plastic that is disposed of in the oceans are driving the market.

U.S. Reusable Water Bottle Market Trends

The U.S. reusable water bottle market is expected to grow at a CAGR of 4.5% from 2025 to 2030. The U.S. is a major shareholder in the reusable water bottle market in North America. Growing environmental concerns among consumers regarding the usage of single-use plastic bottles is driving the demand for reusable water bottles in the country. The U.S. being the dominant market in North America, is characterized by design innovations in the marketspace. The presence of well-established brands as well as co-branding efforts by companies has also been driving the adoption of reusable bottles as an alternative to single-use PET bottles.

Europe Reusable Water Bottle Market Trends

Europe reusable water bottle market accounted for a share of over 20% of the global market revenue in 2024. The European Union’s strict regulations on reducing the usage of single-use plastics and its encouragement for the usage of reusable materials for drinking and dining as a sustainable means to reduce plastic waste has been driving the demand for reusable water bottles. There is also a growing interest in engaging in athleisure and outdoor activities, particularly among the millennial and Gen Z population.

Asia Pacific Reusable Water Bottle Market Trends

The Asia Pacific reusable water bottle market is expected to grow at a CAGR of 5.1% from 2025 to 2030. In Asian countries like India, though most of the PET bottles are or claim to be 100% recyclable, inadequate recycling facilities pose a threat to the environment. It is estimated that only 9% of the plastic produced has been recycled till now, leaving the vast majority to be accumulated in landfills or oceans. Realizing the dangers of plastic water bottles, the government is actively pushing bottle makers to use eco-friendly and sustainable materials, a trend that is likely to drive consumers to actively use reusable water bottles.

Key Reusable Water Bottle Company Insights

The industry is highly fragmented and is characterized by the presence of a few established players, including Tupperware Brands Corporation, SIGG Switzerland AG, and CamelBak Products, LLC, in addition to several small and medium companies such as S’well, Hydro Flask, Nalgene, Klean Kanteen, Contigo, Aquasana Inc., and Hydaway. A majority of the new companies in the market are focusing on establishing a portfolio of stainless-steel bottles as they are naturally BPA-free and an excellent alternative to single-use plastics, to remain compliant with the stringent regulatory frameworks in the industry.

Key Reusable Water Bottle Companies:

The following are the leading companies in the reusable water bottle market. These companies collectively hold the largest market share and dictate industry trends.

- Tupperware Brands Corporation

- SIGG Switzerland AG, GmbH

- CamelBak Products, LLC

- Klean Kanteen

- Contigo

- Aquasana Inc.

- Hydaway

- Nalgene

- S’well

Recent Developments

-

In April 2023. Nalgene revealed that it has switched its reusable bottle production process to Eastman's Tritan Renew, a certified 50% recycled material using the mass balance technique of determination. The conversion process from copolyester to Tritan Renew began in 2020 and was completed by January 2023. The company repurposed over 2.35 million pounds of plastic waste during the conversion process.

-

In February 2023, SIGG Switzerland AG took part in the ABN AMRO Open tennis tournament to provide all players with reusable drinking bottles which took place at Rotterdam Ahoy in the Dutch city of Rotterdam. The bottles provided were made out of Tritan Renew, a super high impact- and scratch-resistant material. The Tritan used for these bottles is certified by the ISCC - International Sustainability and Carbon Certification

-

In December 2022, Klean Kanteen and other outdoor drinkware companies like MiiR, Stanley, and YETI joined forces to create the Drinkware CoLab. They aim to decrease carbon emissions in their supply chain and support the Outdoor Industry Association’s (OIA) goal to become the first climate-positive industry by 2030. The four brands are part of OIA’s Climate Action Corps, which seeks to generate a net-positive benefit, going beyond net zero.

-

In August 2022, S’well launched its Elements Collection of bottles which consists of three high-gloss bottles named 'Blue Marble', 'Charcoal Granite', and 'Opal Marble'. The collection features earthy shades and tones. These double-walled, stainless steel insulated bottles can keep the contents cold for 24 hours and hot for 12 hours. The design prevents condensation, features drip-free sipping and has a wide mouth that accommodates the addition of ice.

Reusable Water Bottle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.08 billion

Revenue forecast in 2030

USD 12.60 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

Tupperware Brands Corporation; SIGG Switzerland AG, GmbH; CamelBak Products, LLC; Klean Kanteen; Contigo; Aquasana Inc.; Hydaway; Nalgene; S’well

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reusable Water Bottle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reusable water bottle market based on the material, distribution channel, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Stainless Steel

-

Glass

-

Silicone

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global reusable water bottle market was estimated at USD 9.67 billion in 2024 and is expected to reach USD 10.09 billion in 2025.

b. The global reusable water bottle market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 12.61 billion by 2030.

b. Asia Pacific dominated the reusable water bottle market with a share of around 34% in 2024. This is owing to the people are moving toward a healthy lifestyle and are thinking of a sustainable environment, thus preferring reusable water bottles against the ordinary disposable ones

b. Some of the key players in the reusable water bottle market include Under Tupperware Brands Corporation, SIGG Switzerland AG, GmbH, CamelBak Products, LLC, Klean Kanteen, Contigo, Aquasana Inc., Hydaway, Nalgene, and S’well.

b. Key factors driving the reusable water bottle market growth include rising awareness of the negative environmental effects of non-disposable and single-use plastic bottles and a major rise in the amount of plastic garbage in seas and landfills.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.